NOAA NMITS: A $2.1 billion Small Business IDIQ / GSA IT70 Contract Holders Only

NMITS IT Opportunity

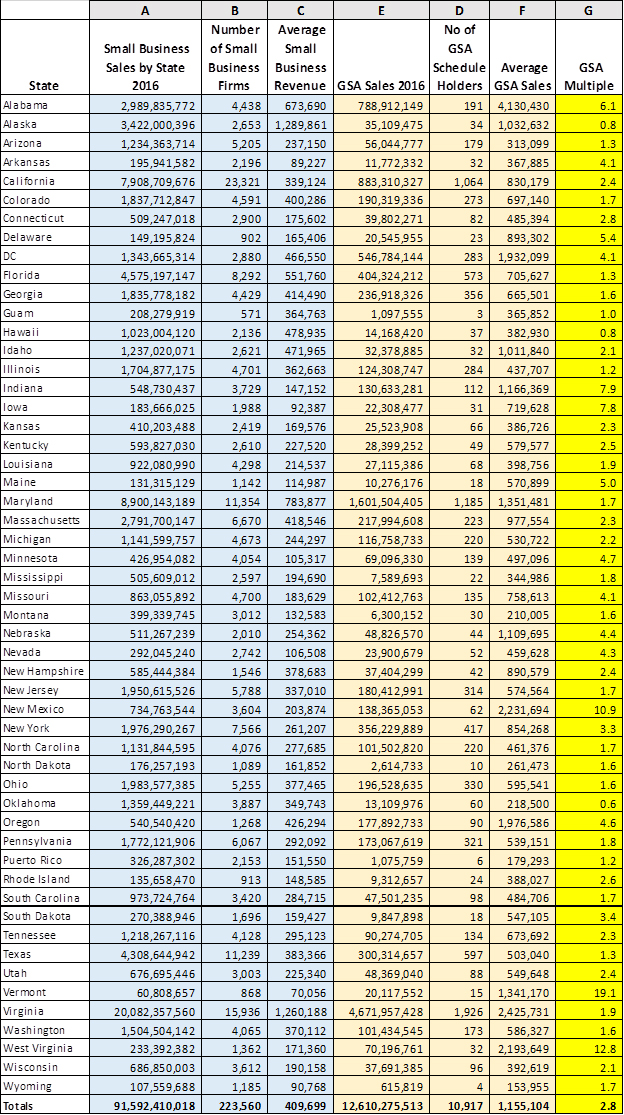

I talk about individual large contracting opportunities from time to time as occasionally I will get an email from someone that never spoke with me in the past but was awarded a place on one of these “difference maker contracts” and sometimes that person is one of our clients. NMITS is a large IT opportunity that I wanted to make sure my readers knew about. It is an additional opportunity for the 4,400 GSA IT70 Contract holders that shared $5.2B in federal IT contracting dollars ($1.2M avg.). This is another example of how having a GSA Schedule can provide a firm with access to large federal IDIQ (Indefinite Delivery Indefinite Quantity) Contracts and the huge opportunity those contracts often represent.

About NMITS

The National Oceanic and Atmospheric Administration which is part of the U.S. Department of Commerce has the mission of understanding and predicting changes in climate, weather, oceans and coasts and marine ecosystems and resources. In order to facilitate this mission they use a great deal of IT and Data Driven Services.

NMITS stands for NOAA Enterprise and Mission Information Technology Services and this $2.1B IDIQ contract is set to be awarded in Federal Fiscal year 2020. NMITS will replace the current NOAALink which contains a broad variety of IT disciplines. NOAA officials said that they anticipated approximately 25 awardees, but that the number is subject to change. This contract is likely to exceed the $2.1B stated amount as NOAALink the contract which NMITS replaces had a minimum $2.5 billion ceiling.

NOAA requires that offerors have a General Service Administration (GSA) Schedule 70 to bid on NMITS. During NOAA industry day, representatives from GSA explained how offerors can acquire or amend their GSA schedules via GSA FASt Lane Program to meet NMITS requirements by the time the RFP is released.

GSA FASt Lane Program

If you currently lack a GSA Schedule but would like to bid the GSA has indicated offerors could use the GSA FASt Lane Program to obtain a GSA Schedule Contract in as little as 60-120 days. NOAA has also indicated it would welcome joint venture and contract teaming arrangements; however, all members must have GSA Schedule IT 70.

Key Selection Criteria

Winning offerors will demonstrate extensive corporate experience and expertise in the service areas listed below in addition to crosscutting experience in program, quality, customer satisfaction, prevention, and continuous improvement management.

IT Professional Services includes

Cloud services (all associated labor);

Cognitive computing;

Conversion and implementation support;

Database planning and design;

Internet of Things (IoT);

IT project management;

Migration services (of all kinds);

Network services;

Programming;

Resources and facilities management;

Systems analysis, design, and implementation; and

Other Ancillary supplies and/or services. I think for the firms that obtain a place on NMITS contract it could be an enterprise altering award and for the rest know that there will be more opportunities like this for GSA Schedule Contract holders down the road.